Survival of the richest: How we must tax the super-rich now to fight inequality

JVL Introduction

Oxfam has just published a new report Survival of the Richest: How we must tax the super-rich now to fight inequality.

It both documents the horrific scale of inequity represented by the Super-Rich and tells us what we need to do about it.

We repost the Executive Summary below. Endnote links are not live, but you will find them at the end of the summary below.

You can download the full report here.

Oxfam: Executive summary

- Elon Musk, one of the world’s richest men, paid a ‘true tax rate’ of just over 3% from 2014 to 2018.1

- Aber Christine, a market trader in Northern Uganda who sells rice, flour and soya, makes $80 a month in profit. She pays a tax rate of 40%.2

Survival of the richest

We are living through an unprecedented moment of multiple crises. Tens of millions more people are facing hunger. Hundreds of millions more face impossible rises in the cost of basic goods or heating their homes. Climate breakdown is crippling economies and seeing droughts, cyclones and floods force people from their homes. Millions are still reeling from the continuing impact of COVID-19, which has already killed over 20 million people.3 Poverty has increased for the first time in 25 years.4 At the same time, these multiple crises all have winners. The very richest have become dramatically richer and corporate profits have hit record highs, driving an explosion of inequality.

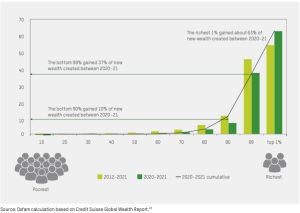

- Since 2020, the richest 1% have captured almost two-thirds of all new wealth – nearly twice as much money as the bottom 99% of the world’s population.5

- Billionaire fortunes are increasing by $2.7bn a day,6 even as inflation outpaces the wages of at least 1.7 billion workers, more than the population of India.7

- Food and energy companies more than doubled their profits in 2022, paying out $257bn to wealthy shareholders,8 while over 800 million people went to bed hungry.9

- Only 4 cents in every dollar of tax revenue comes from wealth taxes,10 and half the world’s billionaires live in countries with no inheritance tax on money they give to their children.11

- A tax of up to 5% on the world’s multi-millionaires and billionaires could raise $1.7 trillion a year, enough to lift 2 billion people out of poverty, and fund a global plan to end hunger.12

This report focuses on how taxing the rich is vital to addressing this unprecedented ‘polycrisis’13 and skyrocketing inequality. It shows how taxing the rich can set us clearly on the path to a more equal, sustainable world free of poverty.

The report explores how, in recent history, taxation of the richest was far higher; how talk of taxing the rich and making billionaires pay their fair share is hugely popular; how taxing the rich claws back elite power and reduces not just economic inequality, but racial, gender and colonial inequalities, too. The report lays out how much tax the richest should pay, and the practical, tried and tested ways in which governments can raise such taxation.

An age of crisis, causing huge suffering for most of humanity

As billionaires, government leaders and corporate executives jet in to meet atop their mountain in Davos, Switzerland, the world faces a dramatic, dangerous and destructive set of simultaneous crises. These are having a terrible impact on the majority of people, something Oxfam sees in its work across the world.

In 2022, the World Bank announced that we will fail to meet the goal of ending extreme poverty by 2030, and that ‘global progress in reducing extreme poverty has come to a halt,’ amid what it said was likely to be the largest increase in global inequality and the largest setback in addressing global poverty since World War II.14 The IMF is forecasting that a third of the global economy will be in recession in 2023.15 For the first time, the UNDP has found that human development is falling in nine out of 10 countries.16

Oxfam analysis shows that at least 1.7 billion workers worldwide will have seen inflation outpace their wages in 2022,17 a real-terms cut in their ability to buy food or keep the lights on.

Whole nations are facing bankruptcy, with debt payments ballooning out of control. The poorest countries are spending four times more repaying debts – often to predatory, rich, private lenders – than on healthcare.18 Many are also planning brutal spending cuts. Oxfam has calculated that over the next five years, three- quarters of governments are planning to cut spending, with the cuts totalling $7.8 trillion dollars.19

An age of crisis, creating huge fortunes for a tiny few

Meanwhile, the scale of wealth being accumulated by those at the top, already at record levels, has accelerated. The global polycrisis has brought huge new wealth to a tiny elite. Over the last 10 years, the richest 1% of humanity has captured more than half of all new global wealth.20 Since 2020, according to Oxfam analysis of Credit Suisse Data, this wealth grab by the super-rich has accelerated, and the richest 1% have captured almost two-thirds of all new wealth. This is six times more than the bottom 90% of humanity.21 Since 2020, for every dollar of new global wealth gained by someone in the bottom 90%, one of the world’s billionaires has gained $1.7m.22

FIGURE 1 SHARE OF NEW WEALTH GAINED (% OF TOTAL NEW WEALTH)

Billionaires have seen huge gains during the pandemic. A flood of public money pumped into the economy by rich countries, which was necessary to support their populations, also drove up asset prices and wealth at the top. This meant that in the absence of progressive taxation, the super-rich pocketed unprecedented fortunes.

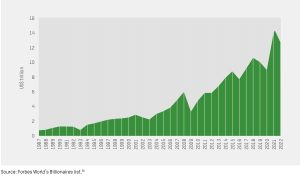

Although billionaire fortunes have fallen slightly since their peak in 2021, they remain trillions of dollars higher than before the pandemic.24 This crisis-driven bonanza for the super-rich has come on top of many years of dramatically growing fortunes at the top, and growing wealth inequality.

The current cost-of-living crisis, with spiralling food and energy prices, is also creating dramatic gains for many at the top. Food and energy corporations are seeing record profits and making record payouts to their rich shareholders and billionaire owners. Corporate price profiteering is driving at least 50% of inflation in Australia, the US and Europe, in what is as much a ‘cost-of-profit’ crisis as a cost-of-living one.25

FIGURE 2 INCREASE IN BILLIONAIRE WEALTH 1987–2022 IN US$ TRILLION (REAL TERMS)

Every billionaire is a policy failure

Extreme concentrations of wealth undermine economic growth, corrupt politics and the media, corrode democracy and propel political polarization. New Oxfam research also shows that the richest are key contributors to climate breakdown: a billionaire emits a million times more carbon than the average person,27 and billionaires are twice as likely as the average investor to invest in polluting industries like fossil fuels.28

The very existence of booming billionaires and record profits, while most people face austerity, rising poverty and a cost-of-living crisis, is evidence of an economic system that fails to deliver for humanity. For too long, governments, international financial institutions and elites have misled the world with a fictional story about trickle-down economics, in which low tax and high gains for a few would ultimately benefit us all. It is a story without any basis in truth.

It is a story, and an economic system that has left us without the tools or even the imagination to face this new age of crisis. It is a system that is largely discredited, yet continues to monopolize the minds of our leaders. It is a system that continues to work very well indeed for a small group of people at the top – predominantly rich, white men based in the global north.29

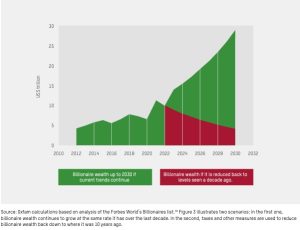

To break the discredited cycle of never-ending billionaire wealth accumulation, governments need to address all the many ways in which the economy is rigged in their favour, including on labour laws, privatization of public assets, CEO compensation and much more. While all of this is needed, Oxfam is using this report to shine a light on one of the key solutions that it believes to hold immense potential: taxing the rich. Oxfam believes that, as a starting point, the world should aim to halve the wealth and number of billionaires between now and 2030, both by increasing taxes on the top 1% and adopting other billionaire-busting policies. This would bring billionaire wealth and numbers back to where they were just a decade ago in 2012. The eventual aim should be to go further, and to abolish billionaires altogether, as part of a fairer, more rational distribution of the world’s wealth.

Tax will play a crucial role in delivering that vision, but it will only happen if we make a drastic break with decades of tax cuts for the rich and corporations.

FIGURE 3 THE OTHER SIDE OF THE MOUNTAIN: TWO SCENARIOS FOR BILLIONAIRE WEALTH BETWEEN NOW AND 2030

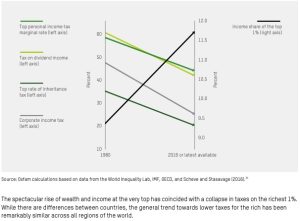

FIGURE 4 IN RICH COUNTRIES, FALLING RATES OF TAX ON THE RICH HAVE COINCIDED WITH A RISING SHARE OF INCOME GOING TO THE TOP 1%

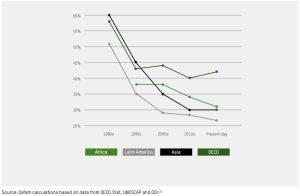

The spectacular rise of wealth and income at the very top has coincided with a collapse in taxes on the richest 1%. While there are differences between countries, the general trend towards lower taxes for the rich has been remarkably similar across all regions of the world.

FIGURE 5 TOP PERSONAL INCOME TAX RATES FOR THE RICH

- For every $1 raised in tax, only four cents comes from taxes on wealth.33 The failure to tax wealth is most pronounced in low- and middle-income countries, where inequality is highest.34

- Two-thirds of countries do not have any form of inheritance tax on wealth and assets passed to direct descendants.35 Half of the world’s billionaires now live in countries with no such tax, meaning $5 trillion will be passed on tax-free to the next generation, a sum greater than the GDP of Africa.36 A new, powerful, and unaccountable aristocracy is being created in front of our eyes.

- Top rates of tax on income have become lower and less progressive, with the average tax rate on the richest falling from 58% in 1980 to 42% more recently in OECD countries. Across 100 countries, the average rate is even lower, at 31%.37

- Rates of tax on capital gains – in most countries the most important source of income for the top 1% – are only 18% on average across more than 100 countries. Only three countries tax income from capital more than income from work. 38

The results have been staggering. Zooming in at the very top exposes that many of the richest men on the planet today get away with paying hardly any tax. For example, one of the richest men in history, Elon Musk, has been shown to pay a ‘true tax rate’ of 3.2%,39 while another of the richest billionaires, Jeff Bezos, pays less than 1%.40 In contrast, one of the market traders that Oxfam works with in Uganda, Aber Christine, pays 40% of her profits in tax.41

Box 1: It doesn’t have to be this way – when the top rate of US tax was 90%

Taxes on the richest used to be much higher. In the United States, the top marginal rate of federal income tax was 91% from 1951 to 1963; top inheritance tax rates stood at 77% until 1975; and the corporate tax rate averaged just above 50% during the 1950s and 1960s.42 There were similar levels

of tax in other rich nations. These high levels of tax were supported across the political spectrum and existed side by side with some of the most successful decades of economic development we have seen.

One of the most strategic tools to fight inequality and combat polycrisis: taxing the rich

Greater taxation of rich people and corporations is the exit door for today’s polycrisis. It can avert austerity, it can be used to fight inflation and higher prices, and it can avoid the unnecessary cruelty of mass destitution and hunger.

Greater taxation is a precondition for successful, strategic governments, giving them the resources to invest in universal healthcare and education; happier, healthier societies; innovation, research and development; the transition to green economies; and stopping climate breakdown.

Together with the Institute for Policy Studies, the Patriotic Millionaires and the Fight Inequality Alliance, Oxfam has used data from Wealth-X and Forbes to calculate that a wealth tax of 2% on the world’s millionaires, 3% on those with wealth above $50m, and 5% on the world’s billionaires would raise $1.7 trillion dollars annually. This would be enough to lift 2 billion people out of poverty. In addition, it could fill the funding gap for emergency UN humanitarian appeals and fund a global plan to end hunger. Beyond this, the tax could help with financing the loss and damage caused to low- and lower-middle-income countries by climate breakdown, and deliver universal healthcare and social protection for all the citizens of low- and lower-middle-income countries (3.6 billion people).43

Taxing the super-rich directly reduces the numbers and wealth of the richest, creating more equal societies, and preventing the emergence of powerful, unaccountable and semi-aristocratic elites. It also reduces corrosive social inequalities.

Previous moments of global crisis have seen increases in taxation of the richest, in the spirit of solidarity. Disappointingly, this did not happen during the peak of the pandemic. Instead, 95% of countries either did not increase, or even lowered, taxes on rich people and corporations.44

The tide is turning…

This polycrisis is now finally shaking up old thinking. The case for taxing the rich more to support people through these crises is increasingly being made across old political divides, including from unlikely institutions such as the International Monetary Fund (IMF) and the European Central Bank (ECB). When the UK government had to backpedal on a battery of proposed tax cuts for the wealthy in October 2022, after an economic and political crisis erupted, it marked a real turning point.45

Visible cracks are now appearing in the decades-long consensus that has driven the agenda of tax cuts for the rich and corporations, but the wall will not break without an active push from ordinary people. The truth is that tax cuts for the rich were never driven by popular demand: polling in many countries has shown that citizens all over the world have long seen taxing the rich more as necessary and common-sense (see Box 2). For change to happen, we need to roll back the political capture that has driven the agenda of ever-lower taxes for the rich and corporations.

Box 2: Taxing the rich – a wildly popular idea, even with rich people

Polling consistently finds that most people support taxing the rich.46 Polling in the US shows that in the last decade, for the first time, the majority of Americans have begun to agree that their ‘government should redistribute wealth by heavy taxes on the rich’.47 An estimated 80% of Indian citizens are in favour of increasing taxes on the rich,48 and 85% of Brazilians are in favour of increasing taxes on the super-rich to finance essential services.49 In Africa, 69% of people polled across 34 countries agreed that it ‘is fair to tax rich people at a higher rate than ordinary people in order to fund government programs to benefit the poor’.50

Even the super-rich agree. In January 2022, over 100 millionaires signed a letter calling for higher taxes.51

As we face these new crises, we must learn the lessons of COVID-19. Governments worldwide should rapidly increase taxation of the richest.

Time for a new common sense

We need to reimagine, reinvent and repurpose our economies to face these crises, in order to urgently build a more equal world and save our planet. In particular, we need to relearn the lessons of our own history, when the rich paid their fair share of tax and those taxes helped fund the expansion of rights such as universal access to healthcare and education.

Inequality is not inevitable. Inequality is a policy choice. Governments can take clear and concrete, practical steps to radically reduce inequality and give themselves the fiscal firepower to protect their people. They can choose to help them safely through crises, instead of imposing unnecessary suffering on them through austerity policies.

How much tax should the richest pay?

Oxfam is calling for every country to implement a mix of taxes that would ensure the richest 1% pay significantly higher rates of tax, paying, for example, 60% of their income in tax, and for multi-millionaires and billionaires to pay higher rates still. This would be a percentage of their total income, from work and from their capital investments.

Rates of around this level would require at least a doubling of today’s average tax rate of just 31% on the personal income of the highest earners across 100 countries, and a quadrupling of the rate on capital gains, which is currently only 18% on average across 123 countries.52 Marginal tax rates of 60% and above on personal income of the rich were the norm for large parts of the 20th century.53 For the super-rich – that is, those with multi-million or billion-dollar fortunes – tax rates should be 75% or higher, to discourage sky-high executive pay.

If governments are to tax income comprehensively, they must ensure that they tax gains from capital at least as much, and preferably more, than income from work. Income from capital is, in most countries, the most important source of income for the rich, and in most jurisdictions it is currently taxed at much lower rates than income from work.

Governments should urgently implement one-off solidarity wealth taxes on the super-rich to claw back pandemic gains driven by public money. Permanent wealth taxes should be implemented, and set at a rate high enough to reduce the numbers of the super-rich. Oxfam has calculated that to simply keep the wealth

of billionaires constant over the last five years, governments would have needed to tax their wealth at a rate of 12.8% each year.54 Reducing the numbers of billionaires and the super-rich should not be achieved by tax alone; other measures are needed to construct an economy that does not produce such extreme disparities of wealth in the first place. Nevertheless, wealth taxes can and should play a pivotal role in closing the gap.

Wealth taxes should include strengthening property and land taxes. Every country also needs a high level of inheritance tax on the super-rich, to prevent inequality being perpetuated for generations and the creation of a new aristocracy. Beyond these taxes, governments should also explore the use of net-wealth taxes.

Time to tax the rich

Greater taxation of rich people is not the only answer to the inequality crisis, but it is a fundamental part of it. It is time for governments to shake off decades of failed ideology and rich elite influence, and to do the right thing: tax the rich.

The revenues raised from this new wave of progressive taxes could then be used to build a fairer, more equal and sustainable future for us all.

Governments must use the tax tools at their disposal to turn back this tide of inequality, following these four steps to a more equal world:

- Introduce one-off solidarity wealth taxes and corporate windfall taxes as well as much higher taxes on dividend payouts to stop crisis profiteering.

- Permanently increase taxes on the richest 1%, for example to a minimum of 60% of their income from both labour and capital, with higher rates for multi-millionaires and billionaires.

- Tax the wealth of the super-rich at rates high enough to systematically reduce extreme wealth and lower power concentration and inequality.

- Use the revenues from these taxes to increase government spending on inequality-busting sectors, such as healthcare, education and food security, and to fund the just transition to a low-carbon world.

Endnotes

-

-

-

- ProPublica. (2021, June 8). The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax. https: www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

- Source: Oxfam in Uganda, Fiscal Justice for Women and Girls project.

- The Economist. (2022, December 12). The pandemic’s true death toll: Our daily estimate of excess deaths around the world [paywall]. Accessed 12 December 2022. https://www.economist.com/graphic-detail/coronavirus-excess-deaths-estimates

- While extreme wealth has been rising for many years (see Section 1.1), extreme poverty had been consistently falling. This changed with COVID-19, which marked the first increase in extreme poverty globally in over two decades. World Bank. (2022). Poverty and Shared Prosperity: Correcting Course. https://openknowledge.worldbank.org/bitstream/handle/10986/37739/9781464818936.pdf

- See methodology note, stat 1.5.

- See methodology note, stat 1.6.

- See methodology note, stat. 1.15. The population of India is 1.39bn. Source: World Bank data. Population, total – India. Available at: https://data.worldbank.org/indicator/SP.POP.TOTL?locations=IN

- See methodology note, stat 2.1

- FAO, IFAD, UNICEF, WFP and WHO. (2022). The State of Food Security and Nutrition in the World 2022: Repurposing food and agriculturalpolicies to make healthy diets more affordable. Rome: FAO. https://doi.org/10.4060/cc0639en

- See methodology note, stat 3.4.2.

- See methodology note, stat 3.14.

- See methodology note. stat. 3.22.

- A global polycrisis occurs when crises in multiple global systems become causally entangled in ways that significantly degrade humanity’s prospects.

- World Bank. (2022). Poverty and Shared Prosperity 2022: Correcting Course, op. cit.; and World Bank. (2022, October 5). Global Progress in Reducing Extreme Poverty Grinds to a Halt. Press release. https://www.worldbank.org/en/news/press-release/2022/10/05/global-prog- ress-in-reducing-extreme-poverty-grinds-to-a-halt

- Gourinchas, P-O. (2022, October 11). Policymakers Need Steady Hand as Storm Clouds Gather Over Global Economy. IMF blog. https://www. imf.org/en/Blogs/Articles/2022/10/11/policymakers-need-steady-hand-as-storm-clouds-gather-over-global-economy

- UNDP. (2022). Human Development Report 2021–2022. https://hdr.undp.org/content/human-development-report-2021-22

- See methodology note, stat 1.15.

- Oxfam. (2022, November 14). G20 must tackle the “cost of profit” crisis causing chaos worldwide. Press release. https://www.oxfam.org/ en/press-releases/g20-must-tackle-cost-profit-crisis-causing-chaos-worldwide#:~:text=In%202021%2C%20on%20average%2C%20 poor,G20%2C%20are%2071%25%20loans.

- Walker, J., et al. (2022). The Commitment To Reducing Inequality Index 2022. Oxfam and Development Finance International. DOI: 10.21201/2022.9325. https://policy-practice.oxfam.org/resources/the-commitment-to-reducing-inequality-index-2022-621419/

- See methodology note, stat 1.2.

- See methodology note, stat 1.5.

- See methodology note, stat 1.4.

- See methodology note, stat 1.0.

- See methodology note, stat 1.14.

- Bivens, J. (2022, April 21). Corporate profits have contributed disproportionately to inflation. How should policymakers respond? Economic Policy Institute. Working Economics Blog. https://www.epi.org/blog/corporate-profits-have-contributed-disproportionately-to-infla- tion-how-should-policymakers-respond/; Unite. (2022). Unite Investigates: Corporate profiteering and the cost of living crisis. Data refers to October 2021–March 2022. https://www.unitetheunion.org/media/4757/unite-investigates-corporate-profiteering-and-the-col-cri- sis.pdf; and The Australia Institute. (2022, July 18). Profits Causing Inflation in Australia, Not Wages: European Central Bank & ABS Data Reveal. https://australiainstitute.org.au/post/profits-causing-inflation-in-australia-not-wages-european-central-bank-abs-data-re- veal/

- Dolan, K.A. and Peterson-Withorn, C (eds). (2022). Forbes World’s Billionaires List: The Richest in 2022. https://www.forbes.com/billion- aires/.

- Maitland, A., et al. (2022). Carbon Billionaires: The investment emissions of the world’s richest people. Oxfam. DOI: 10.21201/2022.9684. https://policy-practice.oxfam.org/resources/carbon-billionaires-the-investment-emissions-of-the-worlds-richest-people-621446/

- Ibid.

- See methodology note, stats 1.10 and 1.11.

- See methodology note, stat 3.9.

- See methodology note, stat. 3.1.

- See methodology note, stat 3.2.

- See methodology note, stat 3.4.2.

- See methodology note, stat 3.23.

- See methodology note, stat 3.15.

- See methodology note, stat 3.14.

- See methodology note, stats 3.2 and 3.8.

- See methodology note, stat 3.12.

- ProPublica. (2021, June 8). The Secret IRS Files, op. cit

- Ibid

- Source: Oxfam in Uganda, op cit.

- Saez, E. and Zucman, G. (2019). The Triumph of Injustice: How the Rich Dodge Taxes and How to Make Them Pay. New York: W. W. Norton & Company.

- See methodology note, stat 3.22.

- Oxfam. (2022, Oct 11). New index shows governments worldwide stoked an inequality explosion during COVID-19 pandemic. Press release. https://www.oxfam.org/en/press-releases/new-index-shows-governments-worldwide-stoked-inequality-explo- sion-during-covid-19#:~:text=The%202022%20Commitment%20to%20Reducing%20Inequality%20(CRI)%20Index%20is%20the,161%20 governments%20during%202020%E2%80%932022.

- Walker, P., Crerar, P. and Mason, R. (2022, October 14). Liz Truss sacks Kwasi Kwarteng before corporation tax U-turn. The Guardian. https://www.theguardian.com/politics/2022/oct/14/liz-truss-press-conference-u-turn-corporation-tax-kwasi-kwarteng

- McCloskey, E. (2022, October 5). Taxing the rich is really, really popular…everywhere. Patriotic Millionaires blog. https://patrioticmillion- aires.org/2022/10/05/taxing-the-rich-is-really-really-popular-everywhere

- Newport, F. (2022, August 12). Average American Remains OK With Higher Taxes on Rich. Gallup Polling Matters blog. https://news.gallup. com/opinion/polling-matters/396737/average-american-remains-higher-taxes-rich.aspx

- Fight Inequality Alliance. (2022, Jan 27). Every 8 out of 10 Indians want tax on the rich & companies profited during pandemic: Fight Inequality Alliance survey. Press release. https://www.fightinequality.org/news/every-8-out-10-indians-want-tax-rich

- Oxfam Brasil. (2022, September 14). Brasileiros defendem impostos sobre mais ricos para financiar renda e assistência social a quem mais precisa. Press release [Portuguese]. https://www.oxfam.org.br/noticias/brasileiros-defendem-impostos-sobre-mais-ricos-para-finan- ciar-renda-e-assistencia-social-a-quem-mais-precisa/

- Isbell, T. (2022). Footing the bill? Less legitimacy, more avoidance mark African views on taxation. Afrobarometer. https://www.afrobarom- eter.org/wp-content/uploads/2022/02/pp78-pap6-less_legitimacy_more_avoidance_mark_africans_views_on_taxation-afrobarome- ter_policy_paper-28jan22.pdf

- Oxfam. (2022, January 19). Over 100 millionaires call for wealth taxes on the richest to raise revenue that could lift billions out of poverty. Press release. https://www.oxfam.org/en/press-releases/over-100-millionaires-call-wealth-taxes-richest-raise-revenue-could-lift- billions

-

-

Gary Stevenson, who prevoiusly made a fortune as a Citicorp trader after the 2008 – and now thinks the entire finance ‘industry’ is immoral and messing up our economy – is very interesting.

His basic point is that wealth inequality causes economic problems because the rich tend to invest their excess wealth in assets (property, etc.), rather than productive enterprises. This creates a vicious cycle stymying economic growth, but also progressively impoverishing the non-rich, who are faced with ever-rising rents and house prices.

In societies which are more equal, more money goes to the non-rich, whose spending – on esssentials and near-essentials – is generally beneficial to the economy, while house rents and prices stay relatively low, meaning everyone can afford a roof over their heads.

See:

https://www.wealtheconomics.org/author/gary/

https://www.youtube.com/c/garyseconomics

Nothing new here. Thomas Piketty laid all this out in his groundbreaking Capital in the 21st Century. The need to tax assets rather than earnings was made very clear in that assets increase in value far greater than wages, thereby constantly increasing inequality.

I’m a Socialist by nature, but I do not believe we should take more than 41% of anything, keep it progressive

We should offer more incentives to mega rich individuals to go back to where they came from and create legacy projects, that will benefit those communities for at least the next 100 years

The problem with obscene wealth is the hoarding of it, spend it or lose it should replace inheritance tax, now that could be 100%

Huge amounts of Inherited wealth is also an evil we should not inflict on our children, leave the bairns alone

Oxfam says ‘tax the rich’.

Socialists say all their wealth is stolen wealth; we have got to get rid of the rich.

One solution: revolution ✊️✊🏽✊️

Well , what a revelation. Simple, understandable,and shocking. I doubt whether the very rich will rush towards this solution. I still can’t see why the super rich need it , surely being a multi millionaire is enough?

It’s bragging rights over the public good.

Oxfam and JVL thanks. Now to share!!

There is clearly something seriously wrong when wealth disparity is so great that some wallow in wealth whilst others starve and struggle. To expect a tax system alone to ensure better wealth distribution is impractical. Taxation systems work when everyone pays a fair share, and it is appreciated that this isn’t always the case. Taxation is not ideal if it is seen as a punishment for accumulating excess. Inequality needs to be addressed before taxation so that vast disparities do not exist. Any idea that fiscal problems can be redressed through merely taxing the rich are misconceived. There aren’t sufficient super-rich people to tax to redress fiscal holes or redress inequalities on the scale the report exposes.

There is however sufficient wealth to tax, it’s a common misconception that all we are talking about is income

My theory is this level of greed and theft came about when the super rich decided being a millionaire was not enough, one simply had to be a billionaire darling, or you are nothing

Question

What was the last thought that passed through the minds of the French Aristocracy as their heads fell into the bread basket