Sanders Bill would hike taxes on big corporations

JVL Introduction

Labour’s lack of vision is startling. It would do well to listen to more radical voices in the States.

There, Bernie Sanders is trying to drive through legislation that would rise taxes on large corporations who pay their CEOs over 50 times what the average worker gets.

Contrast this with Keir Starmer and the shadow chancellor, Anneliese Dodds, who voiced strong opposition to tax rises in the week leading up to the budget earlier this month.

Where is Labour’s vision for a huge programme of public investment in a green new deal, public services and social care?

Where is Keir Starmer?

This article was originally published by Common Dreams on Wed 17 Mar 2021. Read the original here.

Sanders Bill Would Hike Taxes on Big Corporations That Pay CEOs Over 50 Times More Than Median Worker

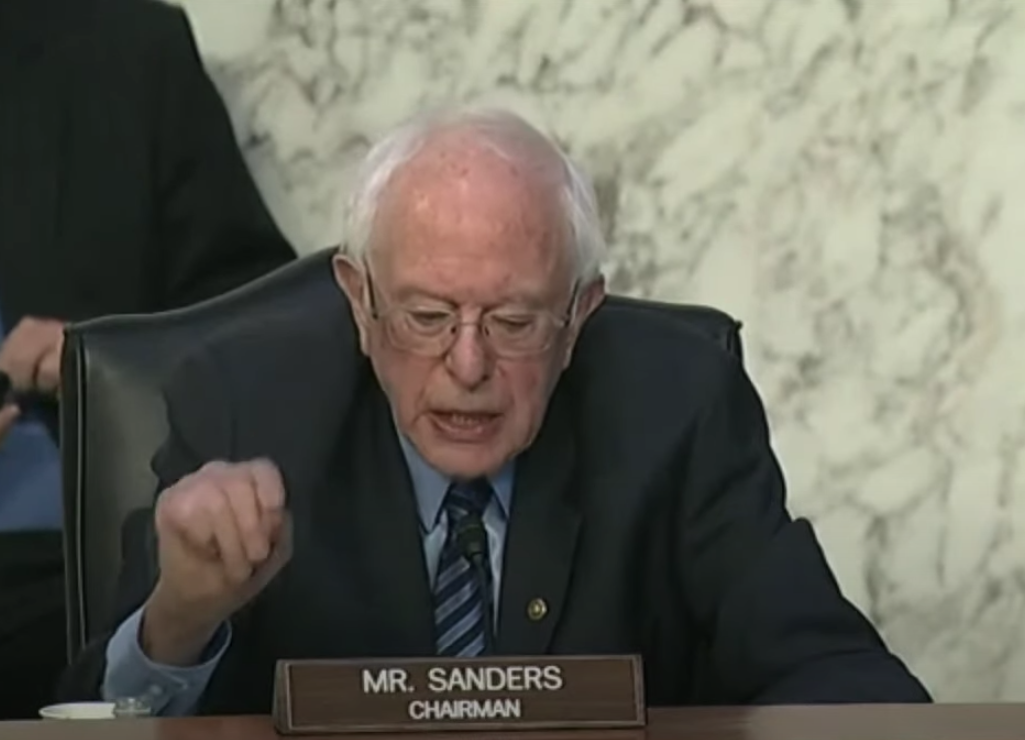

Sen. Bernie Sanders of Vermont on Wednesday unveiled legislation that would hike taxes on large corporations that pay their CEOs over 50 times more than the median worker, an effort to combat the decades-long trend of skyrocketing inequality in the United States.

Under the Tax Excessive CEO Pay Act (pdf), the “corporate tax rate would increase by 0.5% for those companies reporting a [CEO-to-median-worker pay] ratio of 50 to 1, and grow to a rate of 5% for those companies reporting a ratio of 500 to 1 or higher,” according to a summary of the proposal released by Sanders’ office.

“The bill also requires the Treasury Department to issue regulations to prevent tax avoidance, including against companies that increase the use of contractors rather than employees,” the summary notes. “Pay-ratio data for privately held corporations would also be made public, just as publicly held corporations are required to make public under current law.”

In a statement, Sanders warned that the United States is “moving toward an oligarchic form of society where the very rich are doing phenomenally well, and working families are struggling in a way that we have not seen since the Great Depression” due to the coronavirus pandemic and resulting economic crisis.

“At a time of massive income and wealth inequality,” Sanders said, “the American people are demanding that large, profitable corporations pay their fair share of taxes and treat their employees with the dignity and respect they deserve. That is what this legislation will begin to do.”

The Vermont senator’s new legislation—co-sponsored in the Senate by Sens. Elizabeth Warren (D-Mass.), Ed Markey (D-Mass.), and Chris Van Hollen (D-Md.)—came as he presided over budget committee hearing Wednesday that will focus primarily on wealth and income inequality.

Amazon CEO Jeff Bezos, the wealthiest person on the planet, declined Sanders’ invitation to attend the hearing, which also featured testimony from an Amazon employee who works at the Bessemer, Alabama fulfillment center that’s currently in the middle of a closely watched and potentially groundbreaking union drive.

“I intend to talk about the most important issues facing working families,” Sanders told the Wall Street Journal ahead of the hearing. “Right now, I happen to believe that this country is on its way to an oligarchy.”

According to Sanders’ office, the new legislation would bring the federal government around $150 billion in revenue over a decade if current corporate pay patterns continue.

Sanders’ team noted that if the bill had been in effect last year:

- Walmart would have paid up to $854.9 million more in taxes;

- Home Depot would have paid up to $550.8 million more in taxes;

- JPMorgan Chase would have paid up to $172.8 million more in taxes;

- Nike would have paid up to $147.7 million more in taxes.

- McDonald’s would have paid up to $69.5 million more in taxes; and

- American Airlines would have paid up to $22.6 million more in taxes.

“Corporate executives have padded their pockets with hefty paychecks and over-the-top compensation packages, while American workers, who helped generate record corporate profits, have hardly seen their wages budge,” Warren said in a statement Wednesday. “We need to take dramatic steps to address wealth inequality in this country and discouraging massive executive payouts is a good place to start.”

Under Bernie's new bill:

Walmart, which pays its CEO nearly 1,000 times more than its average worker, would pay up to $855 million more in taxes.

CVS, which pays its CEO 790 times more than its average worker would pay up to $450 million more in taxes. https://t.co/GfgulI1by0

— Warren Gunnels (@GunnelsWarren) March 17, 2021

In a research report published last August, the Economic Policy Institute (EPI) showed that top CEOs in the U.S. earned 320 times as much as the typical worker in 2019. Between 1978 and 2019, EPI found, CEO pay soared by 1,167% while typical worker pay grew by just 13.7%.

Rep. Barbara Lee (D-Calif.), a co-sponsor of companion legislation in the House, said Wednesday that it is “unjust and unacceptable that for decades, billions of dollars have gone to those at the top while workers’ wages, especially for workers of color, have remained stagnant.”

“As millions of families struggle to keep food on the table during a global pandemic and economic crisis, it is more important than ever that we close the CEO-worker pay gap and ensure that companies pay their workers the wages they deserve,” Lee added. “I’m proud to partner with Sen. Sanders to reintroduce the Tax Excessive CEO Pay Act to make ultra-wealthy CEOs pay their fair share.”

Dodds and Starmer support a windfall tax on excess profits and McDonnell agrees with their position that now is not the time for a general corporation tax rise on SMEs. Your article is a straw man.

Love Bernie Sanders.

Obscene the amount of tax avoidance/dodging of these big companies.

It might also be asked when is Bernie Sanders ever mentioned

by the Labour Party here?

You would think that given he self identifies as “Democratic Socialist” and has a high profile in the US now he would receive some recognition but no ..

A Resounding Silence ..

@Liz Pole: Your comment merely underlines the lack of socialist vision in the Labour leadership. You and they want nothing more than to emulate Conservative party polices in the hope of copying their vast success in elections. To what purpose beyond that? Labour needs to be a real party of the people which certainly includes increasing corporation taxes now – not at some vague point in the future.

I agree with James

Please allow me to inject a dose of economic realism into this discussion.

Sadly I cannot see this initiative by Bernie Sanders as anything more than political tokenism.

According to the figures cited in the article the measure, if passed, would bring in some $150 billion over a decade, which works out at an average of about $45 per citizen per annum. The most dramatic sounding figure cited of increased tax which would have been payable last year under the scheme is attributed to the case of Walmart: $854.9 million. That represents just 0.6% of Walmart’s gross profits for the year. Is that really what passes for “democratic socialism”? It doesn’t even begin to address the problem of oligopolistic structure. of capital ownership or even the problem of low pay. It merely provides a suitable distraction which will doubtless generate a storm political posturing by various factions of the Democratic party, howls of “Communism” from the Republicans, and it will at best end with some meaningless compromise.

Part of the problem here is that when government revenue or spending are discussed in the media, there is often a complete lack of appreciation of scale when large numbers are mentioned: it seems that for many journalists millions, billions, and trillions are all much of a muchness when discussing government finance. My normative suggestion for dealing with this problem is that all such measures of government finance should always be divided by the size of the population, so that an economic measure is arrived at which represents to the ordinary citizen what the sum really means in its significance for the local economy, in a readily comprehensible manner. Anyone can understand what $45 per annum means to them personally.